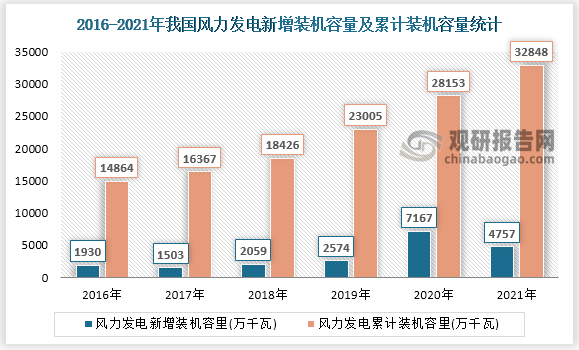

根据国家能源局数据,2020年,我国风力发电新增装机容量为7167万千瓦;风力发电累计装机容量达28153万千瓦;2021年,我国风力发电新增装机容量为4757万千瓦,风力发电累计装机容量达32848万千瓦。

2021年,风电产业链所包含的上市公司中收入规模比较大的环节包括整机、电缆、叶片、塔筒、铸件等,其营业收入为1177.4亿元、954亿元、379亿元、260亿元、135亿元等。

2017-2022Q1风电产业链营业收入情况(亿元)

| 2017年 | 2018年 | 2019年 | 2020年 | 2021年 | 2021Q1 | 2022Q1 | |

| 整机 | 418.1 | 461.5 | 653.6 | 1202.0 | 1177.4 | 176.0 | 214.6 |

| 电机 | 97.1 | 62.0 | 52.0 | 47.0 | 40.3 | 11.7 | 10.5 |

| 叶片 | 236.9 | 257.5 | 271.7 | 374.1. | 379.2 | 84.5. | 92.7 |

| 轴承 | 3.7 | 4.6 | 6.4 | 20.6 | 24.8 | 5.6 | 6.4 |

| 主轴 | 37.7. | 43.2 | 51.5 | 71.6. | 74.0. | 18.5 | 16.4 |

| 铸件 | 63.0 | 71.3 | 97.9 | 129.7 | 134.9 | 31.7 | 27.7 |

| 锻件/法兰 | 15.2 | 30.9 | 38.5 | 57.6 | 55.8 | 14.5 | 9.0 |

| 变流器 | 8.8 | 11.8 | 17.9 | 23.4 | 21.0 | 3.4 | 28.1 |

| 塔筒 | 74.4 | 85.4 | 138.8 | 223.8 | 260.0 | 37.7 | 204.6 |

| 电缆 | 537.2 | 669.4 | 722.9 | 795.2 | 953.7 | 191.1 | 1.8 |

| 高空作业设备 | 2.9 | 3.6 | 5.4 | 6.8 | 8.8 | 1.5 | 214.6 |

| 制动器 | 6.8 | 9.3 | 10.7 | 13.1 | 14.4 | 3.4 | 3.5 |

| 状态监测与故障诊断 | 1.0 | 1.1 | 1.8 | 2.6 | 4.0 | 0.3 | 0.4 |

| 液压润滑流体控制系统 | 6.0 | 6.6 | 8.8 | 12.7 | 15.3 | 3.3 | 3.8 |

| 风电运维船 | / | 1.5 | 1.7 | 2.7 | / | / | / |

| 发电功率预测 | 1.4 | 1.5 | 1.7 | 2.5 | 3.0 | 0.5 | 0.6 |

数据来源:观研天下整理

对不同产业链的单季度同比增速取平均数,20Q3-22Q1的同比增速分别为55.3%、30.8%、53.7%、4.5%、-3.5%、4.3%、7.6%。

2020-2022Q1风电产业链单季度营收同比增长情况

| 2020Q3 | 2020Q4 | 2021Q1 | 2021Q2 | 2021Q3 | 2021Q4 | 2022Q1 | |

| 整机 | 107.2% | 62.8% | 80.9% | 5.6% | 4.3% | -18.0% | 21.9% |

| 电机 | 50.1% | -7.4% | 36. 9% | -32.6% | -40.9% | 9.2% | 9.7% |

| 叶片 | 53.1% | 52.1% | 50.3% | 14.8% | -12.7% | -17.8% | 36.2% |

| 轴承 | 33.1% | 32.3% | 14.4% | -22.6% | -26.2% | 3.6% | -11.8% |

| 主轴. | 50.4% | 33.9% | 30.4% | 8.2% | 4.6% | -11.7% | -13.9% |

| 铸件 | 57.5% | 15.5% | 52.9% | 7.2% | -23.1% | 0.0% | -23.8% |

| 锻件/法兰 | 76.1% | 61.0% | 58.9% | -9.4% | -22.8% | -8.4% | 36.2% |

| 变流器 | 33.1% | 32.3% | 14.4% | -22.6% | -26.2% | 3.6% | -25.5% |

| 塔筒 | 67.1% | 52.5% | 44.4% | -4.1% | 23.0% | 2.5% | 7.1% |

| 电缆 | -0.6% | 27.2% | 23.2% | 14.6% | 29.8% | 13.4% | 15.5% |

| 高空作业设备 | 31.4% | 8.4% | 95.3% | 7.7% | 25.9% | 30.7% | 2.7% |

| 制动器 | 50.3% | -0.1% | 90.1% | -3.4% | -3.5% | -3.6% | 21.9% |

| 状态监测与故障诊断 | / | / | 57.8% | 55.4% | 51% | 45.9% | 50.2% |

| 液压润滑流体控制系统 | 109.6% | 29.3% | 102.1% | 43.9% | -23.4% | 10.9% | 12.9% |

| 风电运维船 | / | / | / | / | / | / | / |

| 发电功率预测 | / | / | / | / | / | / | 26% |

| 平均数 | 55.3% | 30.8% | 53.7% | 4.5% | -3.5% | 4.3% | 7.6% |

数据来源:观研天下整理

单从风电相关收入的毛利率来看,2021年由于原材料成本的大幅上升以及行业抢装退潮之后的装机下降,产业链毛利率普遍承压。除了整机、轴承、电缆等少数环节,大多数都受到了原材料上涨与行业不景气的双重挤压,其中整机、轴承、电缆的毛利率为19.3%、31.6%、42.9%。

2016-2021年风电产业链毛利率(仅考虑风电相关收入毛利率)

| 毛利率 | 2016年 | 2017年 | 2018年 | 2019年 | 2020年 | 2021年 | 15-21平均 |

| 整机 | 24.8% | 26.0% | 24.7% | 22.7% | 18.7% | 19.3% | 23.2% |

| 电机 | 17.1% | 21.5% | -2.2% | -0.5% | 8.5% | / | 10.1% |

| 叶片 | 20.3% | 12.0% | 12.7% | 18.7% | 18.7% | 11.7% | 16.9% |

| 轴承 | 30.8% | 29.7% | 27. .5% | 32.0% | 31.5% | 31.6% | 30.5% |

| 主轴. | 46.1% | 44.9% | 34.7% | 35.0% | 41.1% | 33.7% | 39.0% |

| 铸件 | 44.3% | 34.3% | 27.6% | 25.4% | 26.8% | 21.9% | 32.6% |

| 锻件/法兰 | 43.1% | 25.1% | 18.6% | 21.3% | 23.5% | 19.9% | 26.2% |

| 塔筒 | 31.2% | 22.4% | 19.8% | 23.1% | 23.5% | 20.8% | 24.5% |

| 电缆 | 37.2% | 30.6% | 38.5% | 42.9% | 36.8% | 42.9% | 38.4% |

| 高空作业设备 | 54.3% | 54.7% | 54.9% | 55.8% | 58.4% | 47.7% | 54.7% |

| 制动器 | / | / | / | 36.0% | 40.2% | 34.7% | 37.0% |

| 状态监测与故障诊断 | / | / | / | / | 67.3% | 53.3% | 60.3% |

| 液压润滑流体控制系统 | 23.2% | 21.4% | 19.5% | 22.4% | 28.8% | 25.0% | 23.5% |

| 风电运维船 | / | / | 62.5% | 73.3% | 62.1% | / | 66.0% |

数据来源:观研天下整理

2020-2022Q1风电产业链单季度毛利率情况

| 2020Q3 | 2020Q4 | 2021Q1 | 2021Q2 | 2021Q3 | 2021Q4 | 2022Q1 | |

| 整机 | 15.6% | 15.3% | 21.2% | 21.7% | 17.3% | 18.2% | 22.1% |

| 电机 | 12. 9% | 15.1% | 17.8% | 19.9% | 17.0% | 21.9% | 15.4% |

| 叶片 | 20.5% | 17.2% | 19.5% | 21.2% | 18.1% | 16.5% | 18.7% |

| 轴承 | 33.7% | 24.9% | 27.3% | 29.4% | 37.1% | 29.0% | 34.4% |

| 主轴. | 38.6% | 31.8% | 32.5% | 31.3% | 27.4% | 21.9% | 20.5% |

| 铸件 | 29.0% | 21.0% | 26.6% | 25.4% | 20.5% | 17.7% | 16.4% |

| 锻件/法兰 | 26.1% | 21.3% | 23.3% | 22.4% | 16.2% | 9.4% | 12.1% |

| 变流器 | 37.1% | 32.6% | 45.2% | 34.5% | 36.9% | 30.9% | 35.4% |

| 塔筒 | 29.8% | 18.0% | 29.0% | 25.6% | 22.2% | 19.3% | 16.6% |

| 电缆 | 21.7% | 20.1% | 19.6% | 19.6% | 19.2% | 19.3% | 21.7% |

| 高空作业设备 | 56.9% | 58.6% | 57.4% | 58.7% | 53.2% | 26.9% | 45.9% |

| 制动器 | 42.7% | 32.5% | 38.7% | 41.4% | 35.5% | 36.3% | 32.3% |

| 状态监测与故障诊断 | 65.5% | 69.1% | 69.0% | 61.4% | 65.9% | 57.3% | 60.7% |

| 液压润滑流体控制系统 | 29.5% | 26.9% | 26.2% | 25.7% | 25.2% | 17.2% | 19.2% |

| 风电运维船 | / | / | / | / | / | / | / |

| 发电功率预测 | / | / | 55.2% | 64.7% | / | / | 63.4% |

数据来源:观研天下整理

与毛利率下降相对应的,扣非净利率也面临着较大的压力。21年大部分环节都面临着较大压力,与20年相比,扣非净利率变化由大到小分别为:铸件-3.6%,锻件/法兰-3.2%,主轴-3.1%,高空作业设备-2.8%,制动器-2.0%,电缆-1.9%,发电功率预测-1.9%,叶片-1.3%,变流器-1.0%,整机-0.2%,塔筒-0.2%,状态检测与故障诊断-0.1%,轴承1.2%。

2018-2022Q1风电产业链扣非归母净利率统计情况

| 2018年 | 2019年 | 2020年 | 2021年 | 2021Q1 | 2022Q1 | 方差 | |

| 整机 | -1.5% | 1.9% | 5.6% | 5.4% | 5.9% | 12.0% | 3.0% |

| 电机 | -30.8% | -28.1% | -6.0% | 0.4% | 2.5% | 4.3% | 14.7% |

| 叶片 | 1.8% | 2.9% | 5.8% | 4.5% | 4.1% | 6.0% | 1.4% |

| 轴承 | 11.8% | 14.5% | 18.3% | 19.5% | 17.7% | 19.8% | 4.0% |

| 主轴 | 9.7% | 12.0% | 18.7% | 15.6% | 19.4% | 9.1% | 3.9% |

| 铸件 | 5.8% | 8.7% | 12.9% | 9.3% | 12.2% | 4.6% | 3.3% |

| 锻件/法兰 | 7.7% | 8.0% | 11.9% | 8.7% | 13.2% | 3.9% | 2.0% |

| 变流器 | 0.9% | -3.5% | 12.1% | 11.1% | 18.3% | 14.1% | 12.8% |

| 塔筒 | 5.1% | 9.8% | 12.5% | 12.3% | 17.5% | 5.4% | 3.2% |

| 电缆 | 6.2% | 6.5% | 7.9% | 6.0% | 9.0% | 9.9% | 1.2% |

| 高空作业设备 | 25.5% | 25.9% | 26.7% | 23.9% | 31.1% | 22.0% | 1.1% |

| 制动器 | -12.8% | 6.8% | 11.4% | 9.4% | 14.8% | 15.5% | 8.7% |

| 状态监测与故障诊断 | 9.0% | 18.5% | 19.0% | 18.9% | -54.7% | -47.4% | 4.7% |

| 液压润滑流体控制系統 | -11.6% | 0.7% | 4.1% | / | 3.8% | -1.1% | 5.6% |

| 风电运维船 | 29.6% | 35.9% | 25.5% | 1.6% | / | / | 5.2% |

| 发电功率预测 | 12.8% | 20.9% | 21.0% | 19.1% | 2.8% | 6.0% | 3.5% |

数据来源:观研天下整理

20Q1-22Q1的同比增速分别为77.5%、121.4%、142.3%、70.8%、114.2%、15.5%、6.5%、-39.7%、2.1%,可以看到20Q1-21Q1整个行业取得了高增速,从21Q2开始,同比增速明显下降。

2020-2022Q1风电产业链单季度归母净利润同比增长情况

| 2020Q3 | 2020Q4 | 2021Q1 | 2021Q2 | 2021Q3 | 2021Q4 | 2022Q1 | |

| 整机 | 104.0% | 61.4% | 66.0% | 79.7% | 101.0% | -32.1% | 107.5% |

| 电机 | -191.8% | -97.7% | -142.3% | -128.0% | -95.6% | -122.8% | 65.0% |

| 叶片 | 108.8% | 63.2% | 152.2% | 83.0% | 0.7% | 9.1% | 28.5% |

| 轴承 | 525.1% | 281.5% | 168.3% | 40.0% | 41.7% | -31.1% | 34.0% |

| 主轴 | 165.4% | 87.8% | 87.9% | -0.4% | -33.4% | -54.0% | -57.7% |

| 铸件 | 148.6% | 37.1% | 95.0% | -15.6% | -57.2% | -44.6% | -69.6% |

| 锻件/法兰 | 187.7% | -676.6% | 112.7% | -16.4% | -33.8% | -48.1% | -80.5% |

| 变流器 | 274.2% | 94.0% | 125.1% | -65.7% | -35.1% | 393.4% | 2.0% |

| 塔筒 | 52.9% | 70.6% | 211.2% | -16.5% | 20.3% | -15.3% | -73.4% |

| 电缆 | 28.3% | 33.2% | 54.6% | -57.5% | 2.5% | -97.2% | 58.3% |

| 高空作业设备 | 16.7% | -16.9% | 115.7% | -0.2% | 19.0% | 25. .5% | -13.0% |

| 制动器 | 130.6% | 18.9% | 104.4% | 7.4% | 12.2% | -197.7% | 10.8% |

| 状态监测与故障诊断 | / | / | 86.3% | 34.7% | -41.5% | 40.2% | -4.4% |

| 液压润滑流体控制系统 | / | / | -355.5% | -7.3% | -59.8% | -113.2% | -39.1% |

| 风电运维船 | / | / | / | / | / | / | / |

| 发电功率预测 | / | / | / | / | / | / | 199.4% |

| 平均数 | 19.3% | -5.6% | 63.0% | -4.5% | -11.4% | -20.6% | -2.3% |

| 平均敷(调整后) | 142.3% | 70.8% | 114.2% | 15.5% | 6.5% | -39.7% | 2.1% |

数据来源:观研天下整理

风电产业链的ROA在2021年均出现不同幅度的下滑。具体来看,和20年相比,ROA变化由大到小分别为:轴承-9.5%,锻件/法兰-6.4%,状态监测与故障诊断-6.1%,发电功率检测-5.2%,铸件-4.4%,高空作业设备-4.4%,主轴-3.8%,制动器-2.4%,电缆-2.3%,叶片-1.8%,塔筒-1.8%,液压润滑与流体控制-0.9%,电机-0.4%,变流器-0.3%,整机1.3%。

2018-2022Q1风电产业链ROA情况

| 2018年 | 2019年 | 2020年 | 2021年 | 2021Q1 | 2022Q1 | 方差 | |

| 整机 | 1.1% | 2.8% | 2.5% | 3.8% | 0.6% | 1.3% | 1.1% |

| 电机 | -8.0% | -6.8% | 2.6% | 2.2% | 0.7% | 0.8% | 5.0% |

| 叶片 | 2.1% | 5.7% | 7.0% | 5.2% | 0.7% | 1.6% | 1.9% |

| 轴承 | 10.0% | 14.3% | 23.3% | 13.8% | 2.9% | 2.2% | 5.6% |

| 主轴 | 5.8% | 7.7% | 14.3% | 10.5% | 3.2% | 1.1% | 3.1% |

| 铸件 | 6.2% | 7.9% | 11.3% | 6.9% | 2.1% | 0.9% | 3.2% |

| 锻件/法兰 | 8.3% | 8.8% | 16.5% | 10. 1% | 3.6% | 0.8% | 3.4% |

| 变流器 | 3.2% | 2.3% | 6.6% | 6.3% | 1.6% | 1.5% | 5.4% |

| 塔筒 | 4.1% | 8.7% | 14.3% | 12.5% | 3.4% | 1.0% | 4.0% |

| 电缆 | 8.9% | 9.2% | 10.5% | 8.2% | 2.5% | 2.5% | 0.9% |

| 高空作业设备 | 14.1% | 17.5% | 18.6% | 14.2% | 4.6% | 2.0% | 2.1% |

| 制动器 | -1.4% | 6.6% | 9.4% | 7.0% | 2.4% | 1.9% | 3.7% |

| 状态监测与故障诊断 | 6.3% | 13.9% | 19.7% | 13.6% | -4.0% | -2.0% | 5.6% |

| 液压润滑流体控制系统 | 5.6% | 4.5% | 4.0% | 3.1% | 0.9% | 0.5% | 2.0% |

| 风电运维船 | 10.4% | 12.2% | 11.4% | / | / | / | 0.9% |

| 发电功率预测 | 15.0% | 22.1% | 22.3% | 17.1% | 0.7% | 1.5% | 3.2% |

数据来源:观研天下整理(YA)

相关行业分析报告参考《中国风电设备行业现状深度分析与投资趋势预测报告(2022-2029年)》

【版权提示】观研报告网倡导尊重与保护知识产权。未经许可,任何人不得复制、转载、或以其他方式使用本网站的内容。如发现本站文章存在版权问题,烦请提供版权疑问、身份证明、版权证明、联系方式等发邮件至kf@chinabaogao.com,我们将及时沟通与处理。